Understanding Private Infrastructure’s Role in a Portfolio

Defining the Opportunity

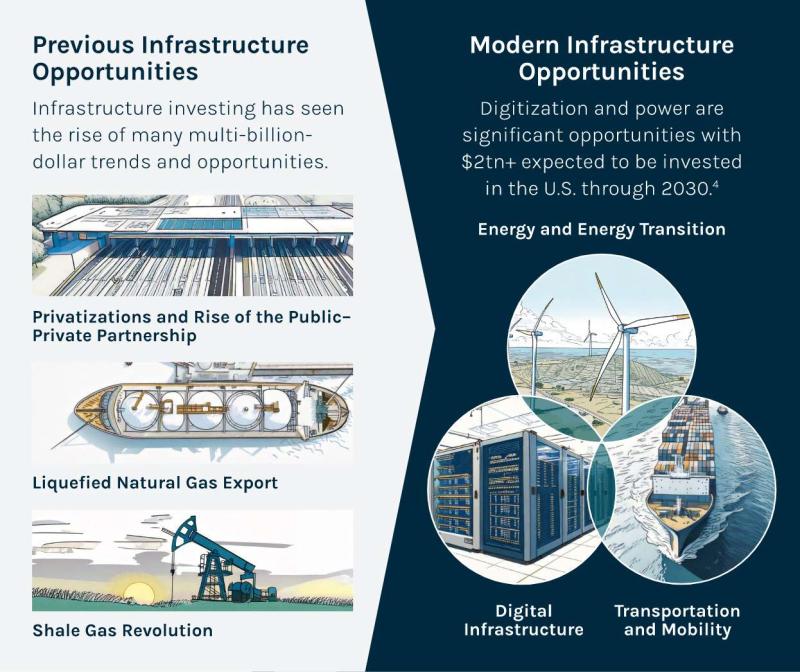

The data and artificial intelligence (“AI”) revolution, the internet-of-things, smart cities, booming power demand; the way we live has changed, creating a “New Economy” in the process. The infrastructure that supports and connects it all is now garnering the recognition it deserves.

Pair these long-term secular tailwinds with a growing portion of funding for infrastructure supplied by private capital, and we uncover what may be a generational opportunity for investors. But what purpose does it serve in an asset allocation, and more importantly, how can you thoughtfully gain exposure to this asset class in your portfolio? In this edition of Private Market Insights, we address those questions.

Our changing lives, the “New Economy” and the infrastructure it requires is a topic unto itself. For more information, please see our article The New Economy: Interconnectedness and the Great Rewiring of Modern Society.

First, we like to set the stage with common characteristics of private infrastructure:

Essential assets: Infrastructure assets provide services that are critical to society (e.g., generating electricity).

Defensive cash flows: Infrastructure assets benefit from long-term contracts that can provide stable revenue streams.

High barriers to entry: Infrastructure projects typically are capital-intensive, time-consuming commitments, which creates the opportunity for significant incumbency moats.

We find that investors like the portfolio enhancing potential of private infrastructure for three key reasons:

- Strong risk-adjusted return potential

- Diversified sources of total returns

- Relative stability during market and economic stress

Packaging these reasons into an asset class in need of immense investment is powerful. Let’s uncover the opportunity.

For more on the benefits of private infrastructure, see our piece Understanding Private Infrastructure.

How private infrastructure can empower a portfolio

1. History of strong risk-adjusted returns

Over the past 20 years, private infrastructure has delivered a ~9% annualized return, outpacing global equities and its listed counterparts. What investors particularly appreciate is the historical consistency of those returns. Private infrastructure has exhibited equity-like returns with closer to bond-like volatility and thus has occupied a favorable position on the risk-return spectrum.

Historical risk and return1

2. Diversification

Perhaps as one of its most appealing qualities, private infrastructure has low-to-moderate correlation to many traditional asset classes. More importantly, it represents access to a different set of assets that have unique return profiles—something we believe investors are seeking now more than ever.

| Correlation to private infrastructure2 | |

|---|---|

| Public equity | 0.58 |

| Agg bonds | -0.05 |

| High yield | 0.48 |

| Public REITs | 0.46 |

| Listed infrastructure | 0.68 |

3. Relative stability during market stress

Not only has private infrastructure historically been somewhat sheltered from public market downturns (evidenced by fewer and shallower drawdowns), but it has also acted as a hedge against inflation and GDP contraction. Even during recessions and inflation regimes, essential hard assets continue to be indispensable.

Putting private infrastructure to work in your portfolio

We believe investors have historically been under allocated to infrastructure relative to traditional asset classes, largely because “public” or “listed” infrastructure has been the primary access point for the wealth channel. Generally, owning listed infrastructure has meant owning heavier, dirtier and older infrastructure or the individual companies that own and operate these assets. For those reasons, public infrastructure has been more similar to lower-beta, lower-return public equities. As a result, many investors today have minimal exposure to the asset class generally through investments that mirror broad market indices.

We believe private infrastructure allows investors to get exposure to the buildout of the “New Economy”—power (e.g., natural gas, nuclear, renewables, battery storage), mobility, digital (e.g., fiber, cell towers, data centers)—a more contemporary investment thesis for infrastructure.

As investors begin to think about adding private infrastructure to their portfolios, a starting point is often core infrastructure. Core sits on the low end of the equity risk-return spectrum for private infrastructure and can see half or more of its return in the form of income. Importantly, core equity represents long-lived, fully constructed, contracted and cash-flowing infrastructure assets. With this in mind, we see the potential for private infrastructure to meet a number of our clients’ objectives—namely boosting total portfolio yield and diversification in the wake of falling yields and rising correlations.

Like other asset classes, the funding source for private infrastructure should be dictated by the needs and goals of the portfolio. For this, we typically look at three scenarios—each with a different end goal in mind:

Illustrative examples of enhancing a 60/40 with a 20% private infrastructure allocation5

A. Goal: Reduce total portfolio risk and increase yield

Funding source: Public equity

Return: +30bps

Volatility: -200bps

Sharpe: ~27% better

Yield: 3.3%

What we have found to be the most common route is funding a private infrastructure allocation from public equity. Because of its historically equity-like returns, more bond-like volatility and low correlation, many investors appreciate the ability to alleviate overconcentration in public equities without necessarily sacrificing return. Based on the model above, through diversification, this option shifts the portfolio sharply to the left, reducing volatility by ~200 bps and increasing yield by ~60 bps.

For the more growth-minded investors with less of a need for immediate income, core infrastructure equity can still be a powerful solution when the cash flow is reinvested and compounded over time. But for those in search of greater potential for capital appreciation, value-add and opportunistic or developmental infrastructure equity can potentially provide a more private equity-like risk/return profile.

B. Goal: Increase total portfolio return and maintain total yield

Funding source: Public fixed income

Return: +120bps

Volatility: +40bps

Sharpe: ~17% better

Yield: 2.7%

Another option is to fund a private infrastructure allocation from the fixed income portion of the portfolio. We have generally found these investors to be willing to take on more downside risk in their pursuit of higher returns. While private infrastructure has half the volatility and drawdowns of public equities, funding infrastructure equity from core fixed income may come with some degree of excess risk.

For other investors, overconcentration in corporate fixed income can be a motivator to add a differentiated source of income to the portfolio. This option moves the portfolio materially higher on the return spectrum, achieving ~120 bps in excess return without giving up yield.

Alternatively, for the more income-oriented investor, infrastructure debt can potentially be a source of premium yield with more bond-like downside risk.

C. Goal: A little of both!

Funding source: Public equity and fixed income

Return: +70bps

Volatility: -100bps

Sharpe: ~22% better

Yield: 3.0%

Finally, we show an equal part debt/equity funding option that may appeal to investors seeking a combination of higher returns and lower volatility. We see this as a reasonable way to work private infrastructure into the portfolio as the asset class blends equity ownership with an income-driven return stream. And, similar to the preceding two options, replacing core equity and fixed income with a higher-yielding asset class may help to bolster the portfolio’s income-producing power. In this option, returns improved by ~70 bps with a strong ~100 bp reduction in volatility and an increase in yield.

Conclusion

As awareness and demand for the asset class continues to expand, we believe private infrastructure will become a meaningful part of individual allocations. However, we recognize the importance of being thoughtful in how you incorporate private infrastructure alongside the rest of the portfolio. We are convinced that private infrastructure is worth considering as its own asset class with unique characteristics, and that it is truly doing something different in the portfolio.